–By Anaadi Shrivastava

Introduction: A Private OEM Entering a Stratified Defence Market

Stumpp Schuele & Somappa Defence, widely known as SSS Defence is among the rare private Indian firms with a defence industrial licence for small arms and ammunition, backed by a 70 year manufacturing legacy through its parent company, Stumpp Schuele & Somappa Springs. Since its founding in 2017, it has pursued a vision of 100% indigenous design, development and manufacture of infantry weapons, ammunition, and related accessories for both military and law-enforcement users, under the broader umbrella of India’s “Make in India” defence policy. SSS Defence

SSS Defence’s significance lies not simply in its products but in what it represents: an attempt to break decades-old dependencies on foreign OEMs and ordnance factories and integrate a private sector Original Equipment Manufacturer into India’s core defence supply chain.

The G72 SMG and the NSG’s 500-Unit Indigenous Procurement

In late December 2025, a significant milestone occurred in India’s defence procurement landscape when SSS Defence emerged as the L1 (lowest bidder) for a contract to supply 500 indigenous 9×19 mm submachine guns (SMGs) to the National Security Guard (NSG); India’s premier counter terrorism force. IDRW, Alphadefense

Contract Award and Significance

The tender, reportedly floated by the NSG in mid-2025, sought 500 9×19 mm carbines with associated accessories to replace or supplement legacy SMGs in close-quarters battle (CQB) roles. SSS Defence’s offering ;widely understood to be the G72 SMG chambered for the NATO-standard 9×19 mm cartridge was evaluated on both technical and financial criteria. After competitors were assessed, SSS Defence’s bid was declared L1, indicating both competitive pricing and satisfactory technical compliance. IDRW

Multiple Indian news outlets confirmed that the indigenous bid outperformed foreign competitors including well known platforms historically used by the NSG in evaluation, marking a tactical and symbolic win for Indian OEMs in elite small arms procurement.

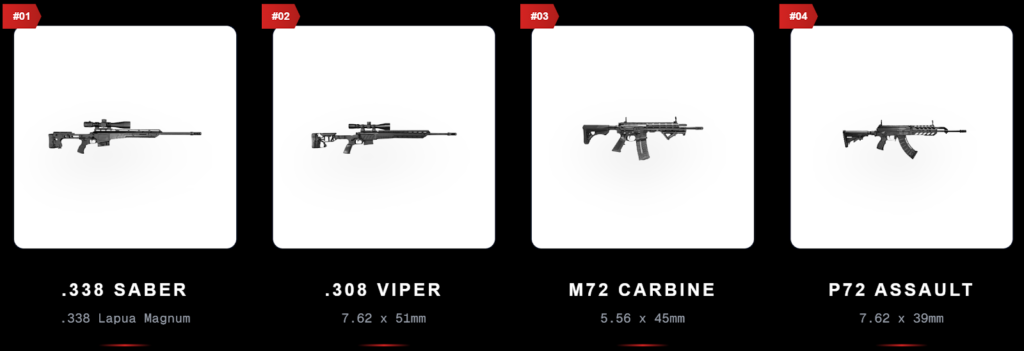

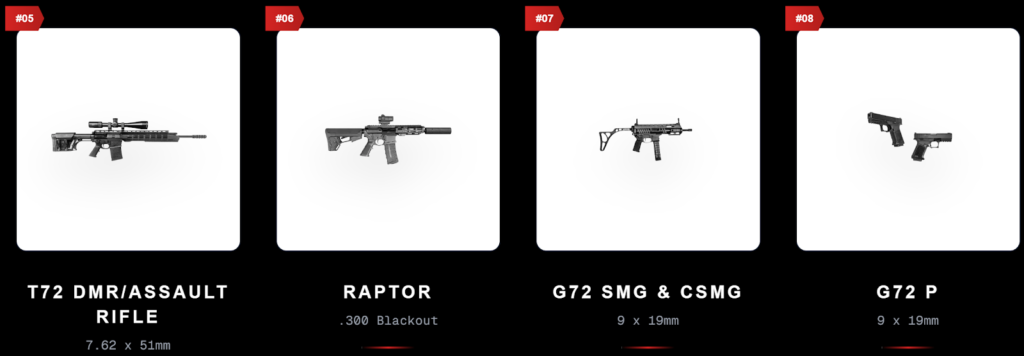

Product Portfolio: From Sniper Rifles to Assault Rifles and Ammunition

SSS Defence’s offerings are focused on small and medium calibre infantry weapons and associated systems: complete weapons (rifles and carbines), ammunition variants, optics, and soon expansion into heavier support weapons. SSS Defence

G72 SMG: Technical Overview

According to official product specifications from SSS Defence, the G72 SMG is a modern, modular submachine gun designed for special forces, law enforcement, and counter-terror units. Its key features include: sssdefence.com

Calibre: 9×19 mm NATO (ensuring compatibility with existing ammunition stocks and logistics)

Operation: Delayed roller-blowback system for controlled automatic fire and accuracy

Rate of Fire: Approximately 950 rounds per minute

Magazine Capacity: 30 rounds

Adjustable Configuration: Configurable barrel lengths (~8.7 inches for CQB or compact operations)

Ambidextrous Controls: Selector and safety tailored for both right and left-hand operation

Rails: Integral Picatinny rails and M-LOK slots for optics, lasers, grips, and other mission equipment

Build: Aerospace-grade aluminium and high-strength steel alloys for durability with low weight

Stock: Side-folding stock to aid transport and close-quarters manoeuvre

These specifications situate the G72 as a modern, highly adaptable SMG capable of performing in intense CQB scenarios; the core mission space of the NSG. Reliability, modularity and ergonomic design are fundamental for elite units where engagement distances are short and reaction times are minimal.

Precision and Long-Range Sniper Systems

The company’s Saber .338 Lapua Magnum sniper rifle and the Viper 7.62×51mm sniper platform are cornerstone products. The Saber, in particular, is chambered in one of the world’s most respected sniper calibres, delivering sub-MOA accuracy out to ~1,500 m; a key requirement for advanced marksmanship roles in both military and special operations contexts. Wikipedia+1

These systems are complemented by proprietary optics, including day and thermal sights designed for military use, emphasizing footprint integration, ruggedisation and ballistic correction for diverse environments. SSS Defence

The Saber .338 LM represents SSS Defence’s most technically ambitious platform.

Key attributes:

- Sub-MOA accuracy potential

- Effective range beyond 1,200–1,500 meters

- Indigenous barrel manufacturing

- Compatibility with modern electro-optics

- Designed for Indian environmental extremes (heat, dust, altitude)

The system has reportedly been evaluated by elite Indian units and has received export interest from friendly foreign countries.

From a strategic perspective, the Saber fills a long-standing gap: a domestically produced long range precision rifle capable of matching global benchmarks like the Accuracy International AX series or Barrett MRAD at lower lifecycle cost and with sovereign control.

P-72 Family: Modular Assault and Combat Rifles

The P-72 family including the Rapid Engagement Combat Rifle (RECR), Recon Carbine and Designated Marksman Rifle (DMR) variants represent a modern, modular suite of infantry weapons designed to cover general purpose, special operations and intermediate precision roles. These weapons are developed with contemporary ergonomics, adaptability to picatinny rail systems, and compatibility with widely used NATO and local ammunition types. Wikipedia

The P-72 platform is a modular family designed to cover:

- Standard infantry assault role

- Close quarter operations

- Designated marksman configurations

Key design characteristics:

- Gas operated, rotating bolt system

- Compatibility with 5.56×45mm and 7.62×51mm variants

- Modular rail architecture for optics, lasers, and accessories

- Cold hammer forged barrels

- Designed for Indian climatic extremes (dust, heat, humidity)

Unlike legacy INSAS or license-built platforms, the P-72 was designed from inception to meet contemporary ergonomic and reliability standards.

While it does not radically outperform Western AR-pattern rifles in raw metrics, its true value lies in indigenous control, lifecycle management, and upgradeability; something India has historically lacked.

Ammunition and Manufacturing Scale

Beyond weapons, SSS Defence has established, in partnership with CBC Global Ammunition, a manufacturing line targeted at standard calibres including 9 mm, 7.62×51 mm, 7.62×39 mm and the .338 Lapua Magnum series. This ammunition venture strengthens India’s sovereignty across small arms logistics and is integral to reducing supply risks seen in wartime or export contexts. SSS Defence

Through collaboration with global ammunition manufacturers, SSS has developed indigenous production of:

- 9×19 mm

- 7.62×39 mm

- 7.62×51 mm

- .338 Lapua Magnum

This matters enormously in wartime planning. Ammunition shortages, not rifles, historically decide combat sustainability. The ability to domestically manufacture match-grade ammunition gives India operational resilience that mere weapon imports cannot provide.

Breaking Through Procurement Barriers: Government vs Private Sector Dynamics

Despite tangible products and engineering IP, SSS Defence’s journey has illustrated the friction within Indian defence procurement particularly when juxtaposed with large foreign OEM procurements.

In mid 2024, India’s decision to procure additional Sig-716 rifles from the U.S. prompted public criticism from SSS Defence CEO Vivek Krishnan, who questioned why indigenous challengers were not more systematically evaluated. Krishnan’s position argues for competitive shoot-offs and transparent benchmarking against imported systems, rather than defaulting to foreign contracts on the basis of legacy relationships. Financial Express

Krishnan and the SSS team’s commentary reflects a broader private-sector view: that Indian procurement rules, certification protocols and prioritisation biases often favour incumbents or foreign integrators, rather than rewarding home-grown engineering at global levels.

The NSG’s selection of an Indian SMG on a significant order like 500 units underscores a growing confidence in private defence OEMs such as SSS Defence. It also reinforces the government’s Atmanirbhar Bharat and defence indigenisation goals by demonstrating that Indian platforms can satisfy elite force performance benchmarks previously dominated by foreign OEM offerings. IDRW

This procurement is anticipated to have a catalytic effect on similar tenders across Central Armed Police Forces (CAPFs) and potentially the Indian Army’s close-quarters weapon requirements, where the preference for established foreign designs has long been the default. By securing the NSG contract on merit and price, SSS Defence is building a strong reference case that could influence future small arms acquisition strategies in India’s security ecosystem.

Demonstrated Adoption: Domestic and Export Engagements

While Army and paramilitary procurement quotas remain contested, SSS Defence has secured significant contracts:

- Uttar Pradesh Police order for 405 indigenous P-72 assault rifles, underscoring law-enforcement trust in private sector OEMs. imrmedia.in

- National Security Guard (NSG) selection of the Saber .338 for sniper category competitions, an important user level endorsement. ThePrint

- Export Orders additional contracts from a friendly foreign nation for the Saber sniper rifle and 7.62×51 mm ammunition (~$30 million), cementing the export potential of Indian defence manufacturing. ThePrint

These engagements reflect not only product validation but also evolving international confidence in Indian OEMs critical for strategic defence diplomacy.

Challenges and Industry Friction: Procurement, Trials, and Policies

Despite positive momentum, SSS Defence has not been insulated from the structural challenges of India’s defence procurement ecosystem:

Evaluation and Trial Processes

Trials of indigenous equipment often involve extensive evaluation cycles. High-level insiders have noted that early iterations of the Saber rifle did not qualify in initial trials for certain elite units, underscoring the rigor required to meet elite force standards yet also illustrating the incremental nature of defence product maturity. The Week

Procurement Rules and Reliance on Foreign Imports

Krishnan’s public comments have highlighted a recurring theme: even after successful induction and validation of indigenous designs, subsequent procurements often revert to foreign systems due to existing contract templates, SOC compliant supply networks, or risk averse acquisition practices. This dynamic has frustrated many domestic OEMs who seek fair contestation based on performance alone. Financial Express

Intellectual Property and Sovereignty

SSS Defence emphasises deep IP ownership and manufacturing self-reliance, positioning itself not as a mere assembler but a creator of original weapon platforms. This contrasts with import-dependent mechanisms where proprietary technologies remain opaque, limiting sovereign control over upgrades, integration and lifecycle support. The Industry Outlook

Strategic and Policy Context: ‘Make in India’ and Defence Industrial Base

The Government of India’s defence policy in recent years has progressively recognised private sector roles through measures like:

- Priority in capital acquisition for Indian OEMs (Buy Indian – IDDM)

- Strategic Partnership Model for niche manufacturing

- Offsets and technology transfer incentives

Yet operational alignment between policy pronouncements and actual contract awards remains uneven, particularly in small arms and ammunition where historical reliance on Ordnance Factories and foreign OEMs has been entrenched.

SSS Defence’s work, therefore, not only tests product capability but also the effectiveness of policy frameworks designed to integrate private innovation into national defence infrastructure.

Future Scope: Expansion, New Weapon Systems, and Export Traction

Looking forward, SSS Defence’s roadmap encompasses:

Product Expansion

- Development of stand-alone grenade launchers and potential light machine gun families indicating a move beyond individual weapons to crew-served and support systems. IDRW

- Enhanced ammunition variants including lightweight cases and next generation projectiles developed in collaboration with partners. SSS Defence

Manufacturing Infrastructure

With facilities in Bengaluru and an ammunition plant in Andhra Pradesh, the company is poised to scale to tens of thousands of units per year, meeting both domestic demands and competitive export markets; a strategic objective aligned with India’s defence industrial expansion goals. SSS Defence

Export Markets

Export contracts signal that Indian defence OEMs can compete internationally, particularly in regions seeking cost-effective, capable small arms without heavy geopolitical strings. Continued foreign orders; based on performance and service feedback, could elevate India’s position in global defence supply chains.

What India Should Do

- Fast-track indigenous rifles into service under limited series production rather than indefinite trials.

- Create assured procurement pipelines for domestic OEMs meeting performance benchmarks.

- Encourage export oriented production through diplomatic and financial support.

- Integrate private OEMs into doctrinal development, not just as vendors but as partners.

- Establish a “Small Arms Innovation Corridor” linking private industry, armed forces, and research bodies.

What SSS Defence Must Continue Doing

- Sustain transparency and technical credibility

- Invest in R&D beyond immediate procurement cycles

- Maintain export momentum to reduce dependence on domestic orders

- Expand into next generation infantry systems (smart optics, fire control, AI assisted targeting)

Conclusion: SSS Defence at the Crossroads of Capability and Policy

SSS Defence exemplifies the promise and friction inherent in India’s private defence manufacturing emergence. On the one hand, it offers proprietary weapon systems, deep manufacturing IP, competitive performance and export validation. On the other, it must navigate entrenched procurement norms, trial rigour, and policy execution gaps.

The continued success of SSS Defence depends not only on product excellence but on structural reforms that allow real competition between indigenous OEMs and foreign suppliers, transparency in evaluation criteria, and a procurement ecosystem that privileges performance and sovereignty over legacy relationships.

In a geopolitical landscape where self-reliance in defence is both a strategic necessity and a policy imperative, SSS Defence’s journey underscores the potential and the challenge— of truly Made in India defence solutions.

GR8 HOING,👏🏻👏🏻👏🏻