The Advanced Medium Combat Aircraft (AMCA) programme represents one of the most consequential decisions in India’s defence aviation history. While the conceptual work on AMCA has been underway for several years, the programme regained momentum after the government released an Expression of Interest (EoI). What makes this phase particularly significant is the Government of India’s decision to keep Hindustan Aeronautics Limited (HAL) out of the manufacturing race, a move that signals a fundamental shift in India’s aerospace strategy.

Understanding the Importance of the AMCA Programme

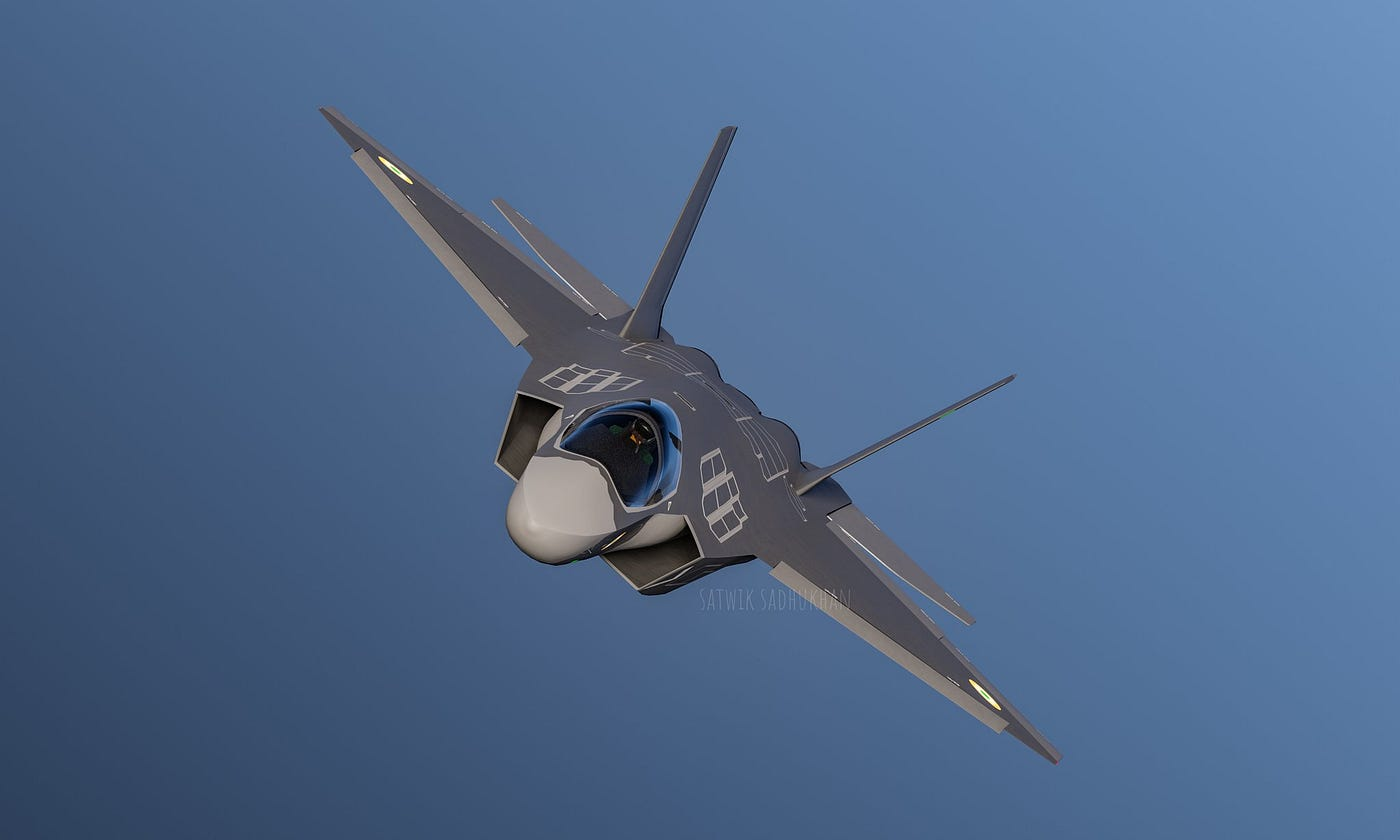

The Advanced Medium Combat Aircraft (AMCA) programme is one of India’s most critical defence aviation projects. It is not just about building a new fighter jet. It is about creating long-term aerospace capability within the country.

Work on AMCA began several years ago. However, the programme gained fresh momentum after the government released an Expression of Interest (EoI). This step restarted serious industrial participation and clarified the execution model.

The most striking decision came soon after. The Government of India chose not to include Hindustan Aeronautics Limited (HAL) as a manufacturing partner. This decision marks a clear break from past fighter aircraft programmes.

Why HAL Was Kept Out of AMCA Manufacturing

At first glance, excluding HAL appears risky. HAL remains India’s most experienced aircraft manufacturer. However, capacity constraints explain the decision.

HAL already holds firm orders for over 180 LCA Tejas Mk1 fighters. It also expects a similar number of Tejas Mk2 orders. Adding AMCA to this workload could stretch timelines and dilute focus.

The government evaluated bidders using practical criteria. These included technical expertise, manufacturing capability, financial strength, and existing order books. On this basis, HAL’s heavy commitments worked against it.

This choice reflects programme realism rather than a lack of trust in HAL.

Shortlisted Private Players and Selection Logic

Out of seven bidders, the government shortlisted three private firms. These are Tata Advanced Systems, Larsen & Toubro (L&T), and Bharat Forge.

Each company brings strength in large-scale manufacturing and systems integration. None of them, however, has built a combat aircraft before. This gap raises valid concerns.

Still, AMCA does not depend on the manufacturer for design leadership.

Design Responsibility and Risk Assessment

The Aeronautical Development Agency (ADA) leads the AMCA design effort. ADA already developed the LCA Tejas series. This experience reduces technical uncertainty.

India plans to follow the standard DRDO–private sector model. Under this approach, government agencies handle design, while industry handles production.

When viewed this way, the execution risk becomes manageable rather than excessive.

Why the Private Sector May Perform Better

Large defence programmes always face delays and roadblocks. India saw this clearly during the Tejas Mk2 development phase.

Private companies usually respond faster to such challenges. They take quicker decisions and adjust supply chains more efficiently. This agility matters in a complex programme like AMCA.

For this reason, private-sector leadership could help maintain momentum.

AMCA as an Industrial Ecosystem, Not Just an Aircraft

AMCA represents far more than a single platform. It requires advanced manufacturing capability that does not fully exist in India today.

Facilities for stealth composites, precision machining, and systems integration must be built from scratch. No current manufacturer owns this complete capability.

The company that builds these facilities will emerge as a major aerospace force in India.

Two-Phase Development and Engine Strategy

India will execute the AMCA programme in two phases.

Phase one will use an existing fourth-generation-class engine. Phase two will feature a more advanced version with a new indigenous engine.

DRDO plans to develop this engine with an international partner. The agency has already released requirements and invited vendors. This parallel effort shows long-term intent.

Consortium Structures and Capability Gaps

Among the shortlisted bidders, Tata Advanced Systems is going solo. L&T has partnered with BEL and Dynamatic Technologies, while Bharat forge with Data Pattern and BEML forms the 3rd consortium.

Even so, no consortium currently has complete AMCA capability. They will need to hire talent, partner with specialists, and build new facilities.

This expansion will take time and strong financial backing.

High Risk, High Reward for India

From a manufacturing perspective, the government has taken a bold risk. AMCA demands patience, funding, and steady political support.

If the programme clears its early stages, India could achieve true aerospace self-reliance. The Indian Air Force would also gain a strategic edge.

Such outcomes justify the risk involved.

What to Expect Next

Within the next three to four months, the government will select a lead consortium. After that, details on factory locations, timelines, and investments will emerge.

AMCA remains a challenging programme. Yet it is also a necessary one. If executed well, it could redefine India’s aerospace industry for decades.